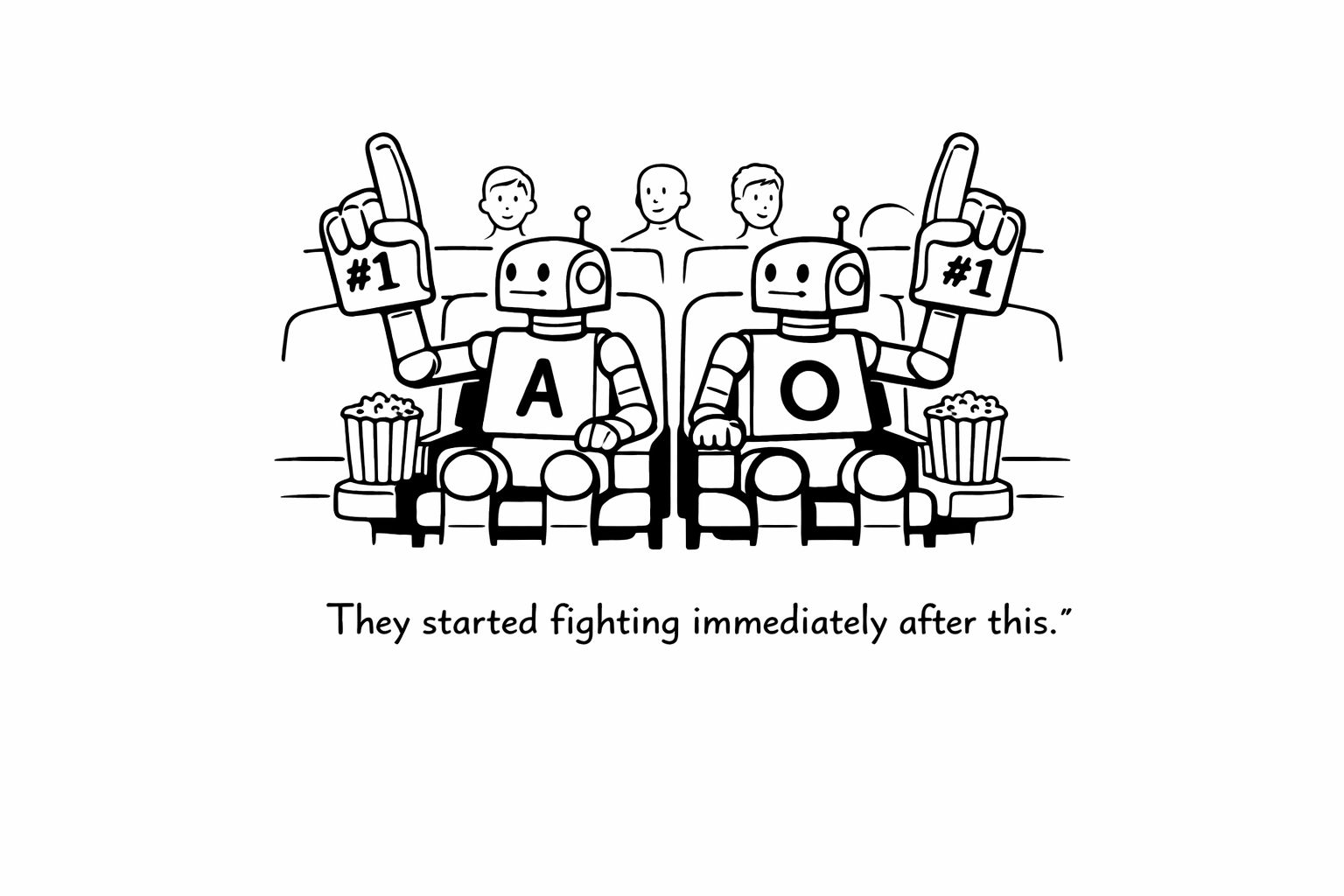

Anthropic and OpenAI Face Off in Super Bowl Ads

AI rivalry went prime time this week as Anthropic aired a television spot during the Super Bowl that took a swipe at OpenAI’s business model. In the ad, a salesman calmly markets shoe inserts before a placard warns, “Ads are coming to AI. But not to Claude,” Anthropic’s chatbot. The company paid millions to reach more than 120 million viewers and trumpet its commitment to an ad‑free service. OpenAI chief Sam Altman called the commercial “deceptive,” arguing that OpenAI had not officially announced a plan to insert ads into ChatGPT. Behind the theatrical sniping is a fight over perception: Anthropic, which was co‑founded by ex‑OpenAI researchers, wants to position itself as a privacy‑minded alternative to a rival accused of selling user data.

Why it matters: The spat underscores the high‑stakes race to control consumer AI interfaces. Both firms are reportedly preparing for public listings and need to differentiate their monetisation models. Running a Super Bowl ad signals that generative AI companies are moving beyond the tech press and directly courting mainstream consumers. Analysts note the rivalry could boost awareness of AI chatbots, which remain underused by the general public.

What’s next: Expect more marketing theatrics as chatbots compete for consumer loyalty. If OpenAI introduces advertisements, regulators may scrutinise how personal data is used to target ads, while Anthropic’s ad‑free pledge could pressure rivals to offer subscription plans. The Super Bowl fight also hints at the broader debate: will the future of AI assistants be funded by ads, subscriptions or something entirely new?

Hardware vs Software: AI Investing Splinters

The AI boom is creating winners and losers, and investors are drawing a hard line between them. On February 5 the S&P 500 software and services index dropped 4.6 %, erasing roughly US$1 trillion in market value since January 28 as fears grew that generative AI will cannibalise traditional software products. Wall Street dubbed the rout “software‑maggedon,” with stocks like ServiceNow, Salesforce and Microsoft tumbling. Analysts at Jefferies and Morgan Stanley said investors had adopted a “sell‑everything” mindset but warned that the panic might be overdone.

Meanwhile, the money is flowing to hardware. An exclusive Reuters report revealed that Vista Equity Partners and Intel are leading a US$350 million‑plus funding round for SambaNova, a start‑up building chips tailored for inference tasks. Vista, known for software deals, and Intel are betting that specialised processors are the new picks and shovels of the AI gold rush. At the same time, high‑bandwidth memory suppliers and other chip makers have seen their shares soar, while investors have become selective about which software firms can adapt.

Why it matters: The divergence highlights a maturation in the AI trade. Investors are differentiating between enablers—firms that supply compute and memory—and potential casualties—software companies whose products may be displaced by generative models. As hardware supply constraints persist, those controlling chips and data centers could wield outsized power, while software firms must prove they can remain “systems of record” amid a wave of automation.

What’s next: Expect more venture capital to chase chip makers and infrastructure start‑ups. Software companies will likely double down on embedding AI into their platforms to fend off disruption. For investors, the question is whether the current selling provides a buying opportunity or marks a paradigm shift toward hardware‑first AI portfolios.

Musk’s Money Machine: SpaceX‑xAI Merger and OpenAI’s Monster Funding Round

Elon Musk is rewriting the playbook on AI financing. Reports indicate that he is considering merging his satellite internet business Starlink with xAI—his ChatGPT rival—to create a combined entity that could raise capital by selling shares in SpaceX. Starlink generates steady cash flows, while xAI is cash‑hungry. By packaging the two, Musk could leverage investor enthusiasm for his rockets and broadband to bankroll his AI ambitions. Critics note that his plan to build solar‑powered data centers in space may be more marketing pitch than near‑term reality, but it illustrates how far founders will go to secure expensive computing resources.

Another capital‑intensive player, OpenAI, is negotiating a funding round that could value the company at US$830 billion and raise tens of billions of dollars. Anchor investors reportedly include Amazon, Nvidia and SoftBank. Nvidia is expected to commit less than the widely rumoured $100 billion but still a “huge” sum, while Amazon is lining up multibillion‑dollar financing tied to computing contracts. The round reflects how AI leaders must balance massive capital needs with the risk of over‑reliance on single suppliers.

Why it matters: AI is now as much a capital game as a technology one. Building frontier models requires enormous compute, and the companies that control capital flows—from satellites to cloud infrastructure—are positioning themselves at the center. These funding maneuvers could set new benchmarks for tech valuations and blur the lines between industries.

What’s next: Musk’s bundling of cash‑generating businesses with moonshot AI projects may inspire similar strategies, while OpenAI’s funding will likely trigger scrutiny over governance and concentration. Expect regulators and policymakers to ask whether a handful of deep‑pocketed firms should control the foundational models that will run everything from search to supply chains.

Goldman Sachs and Anthropic Build AI Co‑Workers

Banking giant Goldman Sachs is preparing to deploy AI agents inside its own operations. According to Reuters, the bank has been collaborating with Anthropic’s engineers for six months to build models that can automate tasks like processing trades, handling client due diligence and onboarding new accounts. The initiative uses Claude, Anthropic’s large language model, and is expected to launch internally in the coming months. Executives say the goal is to streamline routine paperwork and free human bankers to focus on higher‑level tasks, not to eliminate jobs.

Why it matters: This is one of the most concrete examples of a major financial institution integrating generative AI into critical workflows. If successful, it could push other banks to accelerate adoption of AI for compliance and back‑office functions. Regulators, however, will likely want assurances that automated decision‑making does not introduce bias or violate privacy laws.

What’s next: Watch for details on how Goldman handles human oversight of its AI agents and whether other financial players follow suit. Anthropic, meanwhile, could parlay this deal into more enterprise partnerships, bolstering its case against better‑capitalised rivals.

Amazon Deploys AI Studio to Speed Film & TV Production

Hollywood’s next tool could be a cloud‑based AI. Reuters reports that Amazon is quietly developing a “Studio Beta” at Metro‑Goldwyn‑Mayer to accelerate movie and TV production with generative AI. The system, due in closed beta this spring, will give filmmakers access to multiple large language models—likely from Anthropic, OpenAI and others—to assist with tasks like writing dialogue, ensuring character consistency and streamlining post‑production. Executives emphasize that AI will not replace humans; rather, it will help artists iterate faster and reduce costs in an industry where budgets can soar into the hundreds of millions.

Why it matters: Amazon’s move signals that generative AI is moving from experimental shorts to mainstream studio infrastructure. If the beta succeeds, MGM could become the first major film studio with an in‑house generative AI platform, putting pressure on competitors to build or license similar tools. The initiative also shows how cloud providers like AWS hope to tie content creation to their own ecosystems.

What’s next: Unions representing writers and actors, which went on strike in 2023 partly over AI concerns, will be watching closely to ensure that automation does not encroach on creative roles. The beta’s success could determine whether Hollywood embraces AI as a creative partner or resists it as a threat.

Chip Wars: OpenAI Looks Beyond Nvidia for Faster Inference

For the past year Nvidia has been the undisputed supplier of GPUs powering generative AI. Now OpenAI is looking elsewhere. A Reuters exclusive says OpenAI has been testing chips from AMD, Cerebras Systems and Groq because some of Nvidia’s latest processors do not deliver the inference speed required for tasks like coding assistants. The company is seeking architectures that offer larger amounts of on‑chip SRAM, which enable faster retrieval of model parameters during inference. The search for alternatives has slowed negotiations over a potential multibillion‑dollar investment from Nvidia and has prompted the chipmaker to license technology from Groq to boost its own products.

Why it matters: The arms race in AI hardware is shifting from training to inference. As models move from research labs to real‑time applications, latency becomes as important as overall compute. OpenAI’s willingness to diversify suppliers highlights the risk of over‑reliance on a single vendor and underscores the importance of architectural innovation beyond GPUs.

What’s next: Expect startups specialising in inference‑optimised chips to attract significant funding and attention. Nvidia’s dominance is unlikely to disappear overnight, but pressure from customers could accelerate its roadmap and drive new partnerships. For AI developers, the outcome could mean faster, more power‑efficient hardware—and more competitive pricing.

UK Opens Investigation into Grok’s Harmful Content

Generative AI isn’t just attracting investors—it’s also drawing regulators. The UK’s Information Commissioner’s Office (ICO) has launched a formal investigation into xAI’s Grok chatbot after reports that it processed personal data and generated non‑consensual sexualised images and videos. The probe extends to xAI and X Internet Unlimited, the European data controller for Elon Musk’s social‑media platform. Investigators will examine whether Grok violated the UK’s strict data‑protection regime by scraping personal information and producing harmful content without safeguards.

Why it matters: This is one of the first major regulatory investigations into an “uncensored” generative model. The case tests whether existing data‑protection laws can curb abuses by AI systems that generate explicit content. It also underscores the tension between claims of “free‑speech AI” and the real‑world harms that can arise when models are left unchecked.

What’s next: If the ICO finds violations, it could impose hefty fines or require changes to how Grok collects and filters data. Other regulators may follow, signalling a tougher regulatory climate for companies pitching unfettered generative models. xAI and X will need to demonstrate that they can align speed of innovation with safety and compliance.

When Fads Meet Agents: Altman Dismisses Moltbook

At a Cisco AI summit, OpenAI CEO Sam Altman was asked about “Moltbook,” a viral platform where AI bots post on users’ behalf. Altman dismissed the social network as a fad but praised the underlying agentic technology enabling bots to perform complex tasks like controlling robot arms via OpenClaw. He noted that the adoption of AI agents is slower than some pundits predicted, and he argued that the combination of code and large language models is what will truly transform work.

Why it matters: Altman’s comments highlight a divide between splashy AI “experiences” and the less visible but potentially more transformative world of autonomous agents. While consumer hype cycles may fizzle, the ability for AI models to orchestrate tools and systems could be what drives long‑term productivity gains. His remarks also served as a reminder that not every AI‑powered social network will become the next big thing.

What’s next: Developers are experimenting with agentic platforms that can write code, manage files and interact with applications on behalf of users. As these tools mature, expect debates about security and trust to intensify—especially if “AI operating systems” become viable for mainstream users. Meanwhile, platforms like Moltbook may need to prove they offer more than novelty to survive.

CarPlay Opens Up to AI Chatbots

Apple has long kept a tight grip on its in‑car experience, but that may soon change. According to a report citing sources familiar with Apple’s plans, the company will allow third‑party AI voice assistants such as ChatGPT, Anthropic’s Claude and Google’s Gemini into its CarPlay ecosystem. The assistants will not replace Siri—drivers must manually open a chatbot’s app—but they will provide alternative ways to dictate messages or ask for information. Apple declined to comment on the report, which comes amid speculation that the company could use generative AI to revitalise Siri in a future “iOS 18” update.

Why it matters: Allowing rival chatbots into CarPlay would mark a rare concession by Apple and signals the growing influence of AI assistants beyond smartphones. Drivers could choose the assistant that best understands them or connects to their preferred services, potentially eroding Siri’s role as the default. It also shows that Apple is aware of the rapid pace of innovation in generative AI and may be hedging against being left behind.

What’s next: The move could spur competition among AI providers to optimise for automotive use, with features like offline processing, safety assurances and integration with vehicle controls. If successful, it might encourage Apple to open other parts of its ecosystem to third‑party AI, or it could prompt the company to double down on upgrading Siri to stay competitive. Drivers, meanwhile, will finally have a choice of co‑driver.